President Donald Trump has homed in on trade deficits resulting from pacts such as the North American Free Trade Agreement as the root of America’s economic challenges. But in a world without NAFTA, the United States and Mexico would revert to trading with each other based on the World Trade Organization’s Most Favored Nation tariff levels for both countries. It is important to identify which sectors would see minimal change without NAFTA and which would see a disproportionate impact due to a significant tariff increase and large trade volumes. The sectors experiencing the highest impact would logically put the most energy into lobbying for the preservation of NAFTA.

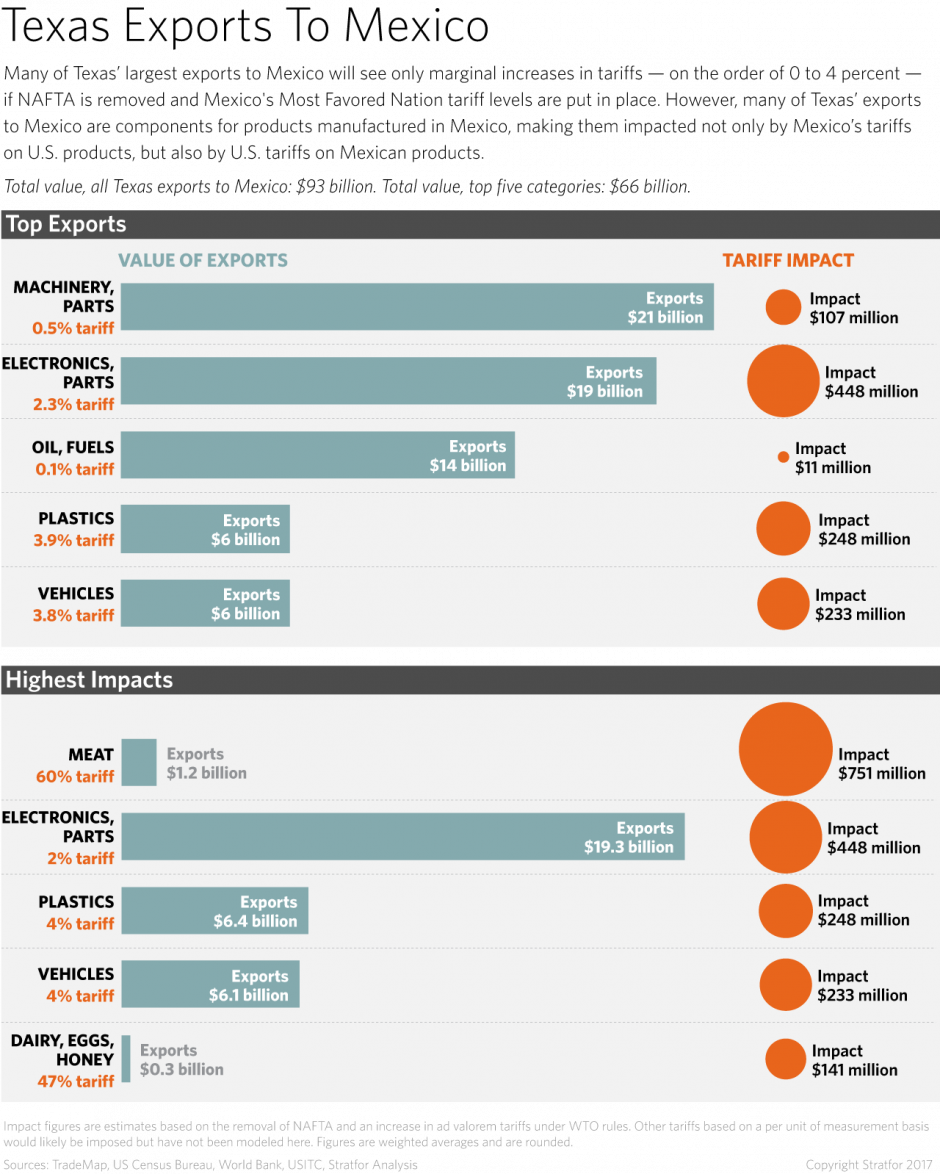

The United States exported $292 billion in goods to Mexico in 2016. The biggest industries that export to Mexico (heavy machinery, electronics, energy and plastics) would only see slight increases in tariffs and would thus be marginally affected. Agriculture, on the other hand, would clearly be the hardest hit. The meat and poultry sector is particularly vulnerable, where some exports could see tariffs jump to as high as 150 percent. Since Texas represents 42 percent of all meat and poultry exports that the United States sends to Mexico, it would bear the brunt of the pain in this sector from tariff hikes. Dairy and sugar would also face a disproportionate impact, facing an average 42 percent tariff and 94 percent tariff, respectively.

The automotive and electronics sectors would also feel a deep impact, but in varied ways. Finished vehicles face average tariffs of 23 to 24 percent, while most vehicle parts would face a negligible tariff of less than 1 percent. That said, for a state like Texas, where 80 percent of its auto exports to Mexico are parts, the impact would be more deeply felt from supply chain disruptions from tariffs applied on components that now move across the border duty-free in cross-border production. Electronics and plastics would see minor tariff increases on average, except for a few narrower categories such as plastic containers and TV receivers and monitors.

When looking at trade from the opposite direction, from Mexico to the United States, most sectors would see lower tariffs on average. But the same big pressure points apply when looking at more heavily protected industries like agriculture (sugars, dairy, vegetables and tobacco are the most heavily protected). The automotive sector — due to its sheer size and intertwined supply chains with Mexico — would also see a large impact in certain categories. While passenger vehicles and parts would only see a 2.5 percent tariff increase on average, vehicles for transporting goods would face a 23.3 percent tariff on average.

Still, Mexico and the state governments and businesses in the United States that would be most impacted by a disruption to NAFTA will also have to game out worst-case scenarios in preparation for negotiations in June.